Security

This is a fraud attempt. NLB never requests this information via phone, email or SMS.

Clicking on the wrong link can cost you dearly – they can steal your credit card information or convince you to buy a non-existent product. Always check the website address and the sender of the link.

Scammers often promise “quick, risk-free profits.” In reality, they want to take your money or personal information.

"Act now or you'll lose your money!" is a popular tactic of scammers. Take your time to check – a reputable bank will never rush you.

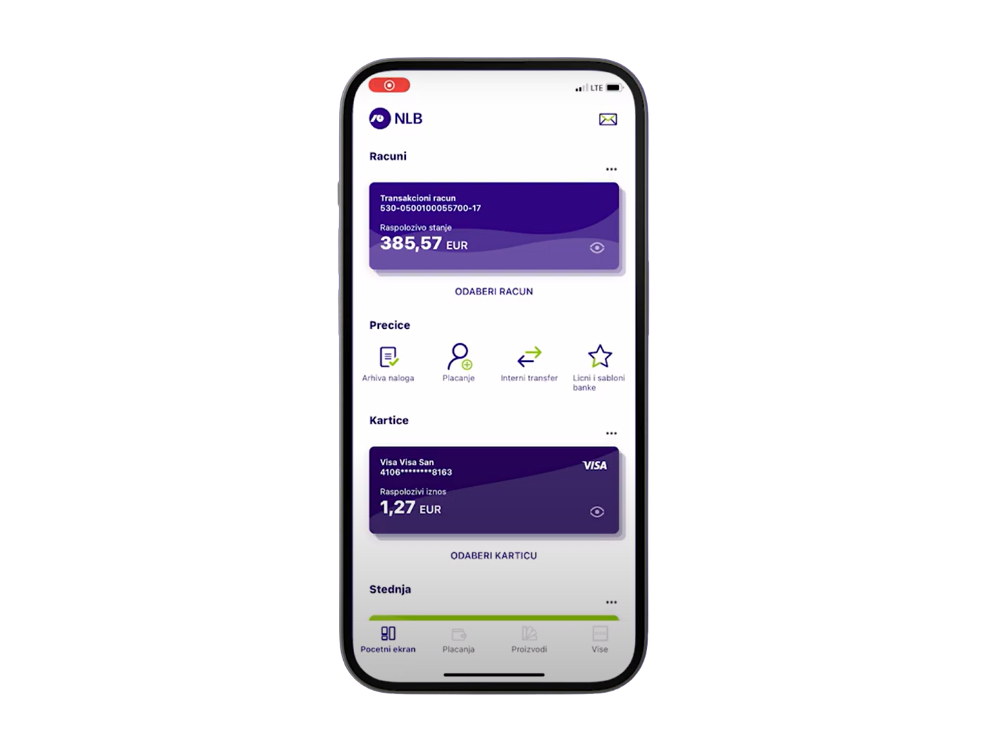

Call our Contact Center at 19888, where we can block your cards, or use NLB Klik 24/7 and leave us a message.

NLB will never ask you for them via email or phone.

Only click on known, verified addresses.

Only buy from trusted sites – an unusually low price or an unknown store often means a risk of online fraud.

This ensures regular updates, technical support, and greater protection against malware.

Do not download unknown mobile applications (e.g. AnyDesk, TeamViewer, etc.).

Regularly monitor your account balance, as fraud can occur even with a delay.

This way you will be immediately informed about what is happening in your account.

Only in this way do you get real protection from viruses, spyware and other cyber threats.

Have you lost or had your card stolen?

You need to block the card through NLB Klik or NLB Pay. If you are unable to do so, please call our Contact Center at 19888 to prevent misuse before it happens.

Pay attention to calls via communication applications (Viber, Whatsapp, etc.) asking you to log in to online or mobile banking. There are known examples of attempted abuse in which fraudsters call users (by phone, Viber application, etc.) and pretend to be technical support, most often from Microsoft. During the phone conversation, they try to convince the user to give them access to their computer and/or mobile phone, allowing them to take full control of their devices. In case you receive a phone call, text message, email or message via other communication applications (Viber, Whatsapp, etc.) that requires you to install software (e.g. mobile applications AniDesk, TeamViever, etc.), please ignore the instructions and do not install such software.

RECOMMENDATION: The bank never requests authentication data by phone or SMS message for using online or mobile banking or any other identifier such as: PIN code, password, one-time password for accessing online banking, three-digit security code on the card.

Fraudsters obtain personal usernames and passwords to access payment channels through fake websites, social networks, emails, or online forms. Phishing scams usually start with a fake email or SMS message, where the sender pretends to be a fake banking service provider. Such messages contain links to fake websites that resemble official banking institutions, where fraudsters obtain security information to log in to an online bank, where they then make unauthorized payments.

RECOMMENDATION: If you receive a suspicious email or SMS, do not open attachments or click on links.

PREPORUKA: Ako ste primili sumnjivu e-poštu ili SMS, ne otvarajte priloge, nemojte kliknuti na linkove.

You have received an email from a business partner informing you of a change in their bank account and asking you to transfer funds to a new account. Be careful, there is a possibility that you have received mail from a scammer. Communication hacking is a type of fraud in which scammers hack into your company's or your business partner's email. The scammer changes the bank account number on the account in order to pay for the goods. This way, the real seller of the goods/products does not receive your transferred funds, because your funds go to the scammer's account.

RECOMMENDATION: Check all suspicious messages - with a simple phone call you can confirm with the sender whether the message sent is a scam or not.

There are advertisements on the Internet or social networks for obtaining a favorable loan. Fraudsters state favorable interest rates and undemanding approval conditions. However, an advance payment of costs is required for the loan approval itself. After paying the initial costs, new requirements usually appear until the user is ready to carry out transactions.

RECOMMENDATION: In the case of bank loans, we never require an advance payment to conclude a loan. The costs are always calculated with the conclusion of the loan. Even an excessively favorable interest rate can be a sign of fraud.

Take your time when shopping online - check the online store carefully and protect yourself from later financial damage. Review the online store's contacts and terms and conditions. Check the website's rating given by customers (e.g. Trustpilot, etc.). You should also pay attention to whether you can return what you bought, whether there is a contact in case of questions or complaints. This way you will more easily recognize which online stores are reliable.

RECOMMENDATION: Pay special attention to extremely favorable offers, i.e. unrealistic prices and the possibility of free shipping worldwide, without restrictions.